We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

The Best Payroll Companies for Small Businesses in 2025

Data as of post date. Offers and availability may vary by location and are subject to change.

*Free demo for a month

The bottom line: Gusto is Business.org’s favorite payroll provider for small businesses. Its basic payroll software plan automates most aspects of running payroll, including automatic payroll tax administration at no extra cost. And its most expensive software plan caters to midsize businesses that want dedicated HR help without fully outsourcing HR or creating an in-house human resource department.

There are other full-service options, too. In particular, we love SurePayroll's beautifully simple approach to payroll that's perfect for beginners.

But full-service payroll software isn’t right for every small-business owner. For instance, if you want fully outsourced payroll and HR, we recommend ADP TotalSource. If you want to keep HR in house but want more features than Gusto offers, Paychex could be a solid choice. Finally, if you only work with contractors, Square Payroll waives its monthly base fee and charges you per payee only.

- : Best overall

- : Best for beginners

- : Best HR + payroll

- : Best PEO

- : Best for paying contractors

By signing up I agree to the Terms of Use.

Compare the top payroll services for small business

Data as of post date. Offers and availability may vary by location and are subject to change.

*Free demo for a month

Gusto is the best overall payroll company for small businesses

Data as of post date. Offers and availability may vary by location and are subject to change.

*Free demo for a month

Gusto comes close to proving that in the world of online payroll software, you really can have it all—from a beautiful, user-friendly interface to a full spectrum of employee benefits. All of Gusto’s plans include these crucial features:

- Unlimited payroll runs in all 50 states

- Automated payroll tax filings

- Direct deposit

- PTO policy creation

- W-2 employee and 1099 contractor management

- Employee pay stubs and tax forms

- Workers compensation administration

- Health insurance add-ons (in 36 states only)

While Gusto doesn’t offer total HR administration, it does include personalized HR help with its priciest plan, Gusto Concierge. If you don’t have enough employees to merit a complete HR department and you’d rather not outsource to a bookkeeper or PEO, the Concierge plan could be a good fit—as long as you’re okay with the high (comparatively, for software) starting price.

However, Gusto’s ratings on the review site Trustpilot has dropped in a big way over the last year, largely because of poor customer service.1

SurePayroll has the most straightforward approach to payroll

Data as of post date. Offers and availability may vary by location and are subject to change.

*First two months are free

If you're looking for a no-frills, straightforward payroll solution, then SurePayroll is your best pick.

Other than its lack of tranparent pricing, SurePayroll is one of the best payroll software titles thanks to its beginner-friendly user interface. For starters, the platform is cloud-based, meaning you can access it from any device anywhere in the world. No software installation is required.

Plus, hands-free perks like automated payroll runs and tax filing make it super easy for thinly-staffed businesses to tackle more with less. Oh, and the platform is chock full of plain English and point-and-click functions, making it a breeze for anyone to adopt without needing a technical background.

Paychex has the best HR and payroll packages for small businesses

Data as of post date. Offers and availability may vary by location and are subject to change.

Paychex recognizes that payroll solutions for small businesses are different from those with over 1,000 employees. That’s why Paychex tailors its payroll plans by business size: it offers solutions for 1 to 9 employees, 10 to 49 employees, and 50 to 1,000+ employees.

Every plan includes payroll processing and payroll tax help, and most plans include some HR basics too:

- Benefits administration

- Retirement management

- Health insurance

- Time tracking

Since most midsize businesses need payroll and at least one of the HR perks listed above, it makes sense to pick a provider that offers two for the price of one—why go through the hassle of integrating one brand’s HR software with another brand’s payroll software when you can easily purchase them both through the same experienced company? Additionally, Paychex has a few PEO plans for midsize to large businesses.

Like ADP, though, Paychex’s plans (both software and PEO) are more expensive than software-only competitors like Gusto, OnPay, and QuickBooks Payroll. And even if you choose Paychex’s payroll software, you’ll pay more for the same services than you would with the competitors listed above: Paychex charges an additional fee for payroll tax filing, insurance add-ons, accounting software integration, and more.

ADP TotalSource is the best small-business PEO

Data as of post date. Offers and availability may vary by location and are subject to change.

PEOs, or professional employer organizations, are HR companies that split ownership of your small business with you fifty-fifty: you handle the business side of the company and the PEO handles the HR side. In technical terms, your employees to the PEO, which then files your taxes under its own company, accepts payroll liability, distributes paychecks, and handles benefits.

ADP is one of the biggest names in the PEO world—and it’s also our top PEO pick for businesses that are big enough to need a separate company to wrangle its HR and payroll needs. ADP also takes over issues like recruiting, hiring, and onboarding. If you have questions about payroll, you can reach out to your dedicated payroll specialist. Just know that when ADP runs your payroll, its payroll team is responsible for any problems with tax deductions.

Plus, as a platform, ADP TotalSource works just as well for employees as employers. Its user-friendly platform has thorough self-service features so employees can check their pay stubs and tax records. And with ADP’s app, they can choose benefits, track time, and request leave or paid time off.

Bear in mind that PEOs are (typically) the most expensive payroll solution. They’re best suited to big businesses with complex HR and payroll needs. If your company isn’t big enough to need a PEO’s assistance, you can always try ADP Run, which is ADP’s full-service payroll and HR software option.

Square Payroll: Best for paying contractors

Data as of post date. Offers and availability may vary by location and are subject to change.

If your graphic design company mostly employs freelancers or your construction business works exclusively with roofing contractors, you don't need a full-fledged online payroll plan (much less a PEO). You need something simple like Square Payroll's contractor plan, which has no base fee—instead, you pay just $6 a month per contractor. You can pause contractor payments anytime, which makes Square Payroll a good pick for employers who work mainly with seasonal workers.

Plus, Square Payroll syncs with the entire suite of Square products. Contractors can clock in and out using Square's point of sale app, which then automatically syncs with Square Payroll to make running payroll a breeze. Square sends out 1099 forms to your contractors at the end of the year and files your 1099-MISC tax form with the IRS too.

If you pay contractors and typical W-2 employees, Square Payroll offers a full-service plan with a $35-a-month base fee. However, while you can use it to easily and affordably pay contractors, that's pretty much all you can do. For instance, you won't get the in-depth reports and analysis you would with, say, Paychex. Then again, if you're just paying contractors, you don't necessarily need that much reporting: you need a cheap online payroll service, and that's what you'll get with Square.

What is payroll software?

Put simply, payroll software manages employee payments. It can be stored either in the cloud or on-site. Many small businesses opt for payroll software because they don’t have an HR department, and the responsibility for payroll falls on the CEO or owner. Since small business owners already have packed schedules, payroll software offers a great solution to help them save time, reduce errors, ensure tax compliance and more.

How does payroll software work?

Payroll software organizes and automates the payroll process by keeping track of hours, expenses and withholdings. It then uses that information to calculate paychecks. This way, you don’t have to worry about keeping a record of and calculating hours, taxes and retirement contributions manually.

How much does payroll software cost?

How much payroll software costs varies depending on the type of service: full-service or self-service. SurePayroll’s self-service plan, at $19, is half that of Gusto’s and Paychex’s full-service plans. This hike in price is because full-service plans tend to include automated tax filing, HR features, health insurance and sometimes support from a payroll specialist. Most of the companies we recommend offer full service, however, and average out to $38 for a monthly base subscription plus $5.50 per employee.

More advanced payroll software plans (which tend to have lots of HR features) keep their pricing exclusive and ask you to contact them. The word online, however, says that payroll software can go up to at least $150 for a base price. So there you have it, payroll software can range anywhere from $19 to $150 per month — with the per employee cost averaging around $5.50.

Which type of payroll provider is right for you?

From running payroll by hand to outsourcing all of payroll and HR to a third party, small-business owners have multiple options for paying their employees. Here are the most common payroll solutions:

- Payroll templates and calculators can help business owners with just one or two employees calculate paychecks and assess payroll taxes on their own.

- Self-service payroll software helps you calculate paychecks, deduct taxes, and fill out tax forms. It leaves the actual tax filing entirely in your hands.

- Full-service payroll software calculates paychecks and automatically files payroll taxes on your behalf. Most full-service payroll options also include optional HR features and employee benefits, such as health and vision insurance.

- Virtual bookkeepers can organize your business’s finances from afar, and most of them also offer payroll and tax-filing services for an additional cost.

- PEOs, or professional employer organizations, are large companies that partner with your business to manage every aspect of personnel management.

For a more in-depth exploration of each type of payroll provider, including their pros and cons, read through our ultimate guide to small-business payroll.

The takeaway: Which payroll company is best for you?

Whatever your number of employees or the types of day-to-day HR tasks you need tackled, there’s a payroll company and service out there for you:

- If you’re in the market for full-service software with handy HR add-ons and stand-out employee benefits, we can’t recommend Gusto highly enough.

- If you'd like your taxes automated or you're a household business, we recommend SurePayroll.

- If you’d rather keep HR and payroll in house while getting maximum HR support, Paychex offers comprehensive, customized packages.

- For fully outsourced HR assistance, ADP TotalSource’s PEO streamlines human resource tasks for employers and employees alike.

- Square Payroll provides hands-off full-service payroll at an incredibly low price for employers that pay 1099 contractors only.

Want more small-business payroll options than the five listed here? Our piece on the best payroll software for small businesses overviews 10 of the best payroll software options for businesses like yours.

Still not sure? We’ll help you nail down the right payroll software for your business.

Payroll services FAQ

Since every business has different needs, it’s hard to objectively determine the best payroll service provider. But we have a few favorites, starting with Gusto, a full-service payroll software provider with add-on employee benefits. (If you’ve already read our Gusto review and don’t think it’s right for you, QuickBooks Payroll and OnPay offer similar software services at a lower price.)

Want another company to manage most of your payroll and HR services? Try Paychex or ADP, both of which offer in-house software and fully outsourced PEO services.

Self-service payroll means in-house payroll. You might use software to run the numbers and simplify direct deposit, but in the end, you’re responsible for payroll tax compliance and making sure employees get paid the right amount.

In contrast, if you run full-service payroll, you outsource at least some parts of your payroll process to another company.

Full-service payroll usually costs more than self-service payroll, but it saves you time, which could translate to saved money. Most importantly, a full-service payroll company takes on the responsibility for withdrawing the right amount of taxes. If there’s an issue with federal or local taxes, it’s the payroll company’s problem, not yours.

Should you use a payroll service or hire an accountant?

In general, payroll services are cheaper, especially if you go the self-service rather than full-service route. Many payroll companies also combine payroll with features like HR administration, time tracking, and employee benefits that are outside the scope of an accountant’s job.

A full-time in-house accountant costs substantially more than payroll software and can’t juggle as many tasks as payroll software can. However, accountants can help analyze your business’s finances, file taxes easily and accurately, draw up financial statements, and help you understand your business’s future.

Also, remember that the question isn’t necessarily either/or. You can use self-service payroll most of the year and hire an accountant for a few hours a week during tax season.

Methodology

To find the best payroll companies for small businesses, we gave 15 of our top payroll brands an in-depth look, assessing their strengths and weaknesses in the following key areas:

- Payroll features, such as automatic payroll runs, direct deposit, and payroll tax administration

- HR features, such as workers compensation insurance, health benefits administration, and optional employee benefits

- Scalability, including the number of plans available from each provider

- Pricing, including the number of features included at each price point

- Customer service reputation, including customer service hours and customer reviews on sites like Trustpilot and Trustradius

Sources

1. Trustpilot, “Gusto.” Accessed February 14, 2023.

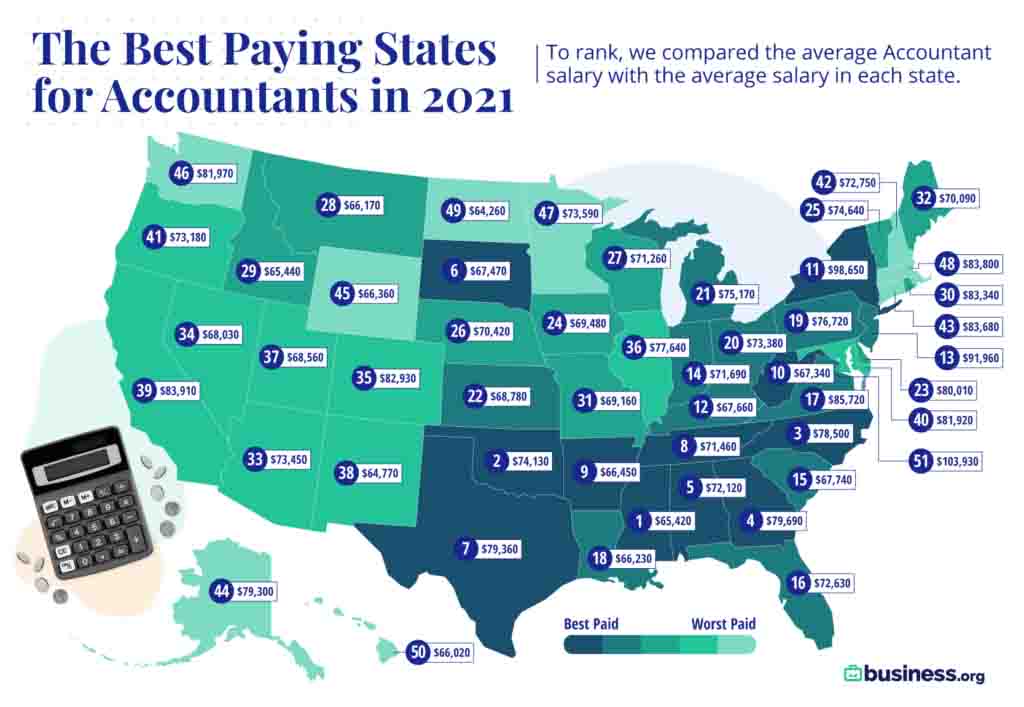

The Best (and Worst) States for Accountants

In 2020, there were just over a million accountants employed in the United States. Collectively, they earned an annual average salary of $79,520 a year.1 That’s nearly 50% more than the average national salary1—so no matter where you live in the US, it’s safe to say that being an accountant pays off.

But just as with any career, accounting’s profitability differs from state to state. For instance, accountants in Washington, DC are paid a higher salary than accountants anywhere else in the nation. But with DC’s higher cost of living—and the fact that DC accountants make only 15.7% above the average salary there—DC is actually the worst area for accountants who want their dollar to go as far as possible.

In contrast, Mississippi ranks first on our list, with accountants there making 63% more than the average salaried worker in the state. That’s an average wage of $65,420, which goes pretty far in the state US News just named the most affordable in the US.2 Keep reading to learn where your state falls on the list.

Methodology

To find the average state salary for accountants, we used data from the US Bureau of Labor’s annual occupational employment stats. To get our rankings, we compared each state’s average accounting salary to the state’s overall salary.

Our key findings

- Eight of the states in our top ten are in the South, where the cost of living is low compared to the nationwide average. The exceptions to this regional win? Oklahoma, which comes in second, and South Dakota, which takes sixth place.

- In contrast, none of the states in our bottom ten are in the South. (Washington, DC, however, comes in dead last.)

- While South Dakota is in our top ten best states, North Dakota is the third worst. If you’re an accountant trying to decide which of the two Dakotas to live in, we’d say the answer is pretty clear.

- If you’re trying to maximize your income, the states at the edges of the map aren’t a good bet. Alaska and Hawaii are both in the bottom ten.

State-by-state analysis of accountant earnings

The takeaway

Being an accountant is a good gig no matter where you’ve put down roots. But if you want to up your earnings a bit (or if you’re willing to take a pay cut in a state where each dollar goes a lot farther), relocating to one of our top ten states could be your best career move yet.

Related reading

Sources

1. U.S. Bureau of Labor Statistics, “Occupational Employment Statistics: May 2021 Occupation Profiles.” Accessed May 2, 2023.

2. Madeline Fitzgerald, US News, “The 10 Most Affordable States for Professionals,” October 19, 2022. Accessed May 2, 2023.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.