We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

The 5 Best Startup Business Loans of 2025

Data as of post date. Offers and availability may vary by location and are subject to change.

Don't qualify for a traditional small business loan? Consider a personal loan or a business credit card.

Bottom line: Most startups will like Lendio best, since it gives you a shot at many lenders and kinds of loans. But in our rankings below, we’ll tell you about all the best startup business loans out there—and how to qualify for it—so you can make business boom.

In this ranking, we’ll focus on startup business loans you can qualify for with one year or less in business and $150,000 or less in annual revenue—in other words, business financing young startups can actually get.

As a startup business owner, you have so many opportunities and so much potential—if only you can work through cash flow problems that threaten to bring your business grinding to a halt. But you already know that. You just need to know how to get the financing to grow your startup.

We researched more than 50 business lenders and found out which ones lend to startup businesses.

By signing up I agree to the Terms of Use and Privacy Policy.

Compare the best startup business loans

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

Lendio: Best overall for startup loan for business

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

With everything from equipment financing to lines of credit to long-term loans, Lendio offers one-stop comparison shopping for small-business loans.

Lendio isn't what you'd call a "traditional" lender. Instead, it's a lending marketplace that partners with 75 or so lenders to help you find the right loan for your needs. So instead of spending time applying to multiple lenders to see who will approve you and what kind of offers you get, you fill out just one application and get multiple loan offers to compare and choose from.

To qualify for a Lendio loan, you’ll need to have been in business for six months and have at least a 500 personal credit score. Now, meeting those bare minimum qualifications won’t get you the lowest rates or biggest loans. But given that Lendio works with more than 75 lenders (including some we recommend below), there’s a good chance you’ll find some kind of funding for your startup.

Yes, these options we are offering in this article do truly rock but even if the offering is great, not every business owner qualifies for a small-business loan. If you aren't able to secure a loan for your startup, you may be able to apply for a personal loan or a business credit card. Enter some basic information about your business below, and we can refer you to potential lenders that meet your needs. (Please note that only certain lenders allow customers to take out personal loans with the intent to grow a business.) Of course, if you do want to go the traditional startup business loan read on below for more in-depth reviews of other financing options.

Bluevine: Best for low rates

- 625 min. credit score

- $40,000 min. monthly revenue

- 2 years min. time in business

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

Want to try for a low interest rate? A line of credit from Bluevine could work nicely for you.

Bluevine’s rates start at under 7% interest, making it competitive not just with other online lenders, but with traditional lenders too. Put simply, it can cost less than many other lenders on this list (especially ones that use fees instead of interest).

That said, Bluevine does have comparatively high credit score and annual revenue requirements. And we do want to remind you that 6.2% is just its starting interest rate―your actual rate could end up quite a bit higher.

All the same, Bluevine’s low starting interest makes it an attractive lender for startup businesses.

Fundbox: Best for poor credit

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

Like Bluevine, Fundbox offers business lines of credit. Unlike Bluevine, Fundbox accepts applications from businesses with "poor" personal credit scores (starting with a FICO score of 600). And a line of credit from Fundbox is a much safer, sturdier loan choice for small-business owners with poor credit than, say, a merchant cash advance.

On the flip side, Fundbox's maximum loan amount is $150,000. That amount will work nicely for many startups, but if you need a higher business line of credit, we recommend looking at Bluevine instead.

OnDeck: Best for repeat borrowing

- 625 min. credit score

- $100,000 min. annual revenue

- 1 yr. min. time in business

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

We’ll be honest: OnDeck doesn’t have the best deals for first-time borrowers. But OnDeck gives repeat borrowers lots of perks, including reduced (or even waived) fees and lower APR on loans. So if you need a term loan for your startup now, and you think you’ll need more business loans in the future, OnDeck might be a good fit. And there’s no better time to start building that beneficial relationship with OnDeck than right now.

OnDeck has pretty reasonable application requirements for startups: a 625 credit score, one year in business, and $100,000 in revenue. Now, those application requirements are higher than some others on this list (notably Bluevine), so OnDeck isn’t for everyone and every business. But if you meet or exceed those qualifications, and you want to create a long-term relationship with your lender, then OnDeck might be right for you.

Kiva: Best for microloans

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

What if you didn’t have to pay interest on your financing? With Kiva, you don’t. It offers 0% interest on all its microloans. Sure, you’ll have to start the crowdfunding process by getting your family and friends to pitch in some funding (a process that can take more than 30 days), but what other lender offers interest-free loans?

Do keep in mind, though, that Kiva microloans go up to only $15,000. That’s a much lower maximum loan size than you’ll find from other lenders. (They’re called microloans for a reason.)

Of course, if you’re just getting started, a Kiva microloan might be more than enough.

Types of startup business loans

Traditional loans and lines of credit are great, but they’re far from the only way to finance your business.

And in fact, you may have a hard time getting loans, lines of credit, or other business financing for your startup. Lenders prefer to loan money to older businesses with high revenue. If you’ve got a young business―especially one without much revenue yet―even the lenders on this list may seem out of reach for now.

No need to panic, though. Like we said, you’ve got other options.

If you want to grow your startup, you can also consider other small-business funding options like these:

- Personal savings

- Personal loans

- Business credit cards

- Business grants

- Family and friend investments

- Angel investors

- Venture capitalists

- Crowdfunding sites

Sure, these alternative funding options have their downsides. It can take a long time to get investors, for example. Business grants are super competitive. And only certain lenders can legally allow you to use a personal loan to finance a business.

But these other forms of financing also have a big advantage: Your business’s age and revenue don't matter as much.

So while we do hope one of the small business loan lenders on this list works out for you, don’t forget about all the other options available to you and your business.

Honorable mentions

The lenders above are our favorites for startup businesses—but if none of are favorite lenders work for you, we have a few other recommendations. Note that several of our honorable mentions are merchant cash advances. We only recommend turning to a merchant cash advance if you're certain you can pay the loan off as soon as possible. Be sure to read up on merchant cash advances before applying.

Compare the best startup financing: Honorable mentions

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

Kabbage: Best for monthly payments

- 660 min. credit score

- 3,000 min. monthly revenue

- 1 yr. min. time in business

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

Worried about how weekly or daily payments could affect your cash flow? Then try applying with Kabbage.

Kabbage uses a monthly payment schedule, making it unique among online lenders. For businesses with tight budgets, that can free up cash flow for the rest of the month.

Just watch out for the monthly fees with Kabbage. If you repay your funds quickly, they’re not bad. But if you take more than a few months, they’ll add up before you know it.

Lendr: Best for merchant cash advances

- Min. credit score unlisted

- $10,000 min. monthly revenue

- 1 yr. min. time in business

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

As a rule, we dislike merchant cash advances and think you’re better off without them. If you’re determined to get one, though, we suggest going with Lendr.

Lendr has a couple key things going for it. Unlike other cash advance companies, Lendr clearly lists its rates and fees on advances. And it also earns much better customer reviews than many of its competitors.

To be clear, its cash advances still cost a lot. And if you don’t read carefully, the repayment method and schedule can still catch you by surprise. If you borrow carefully, though, Lendr may work well for your startup.

Square Loans: Best for Square users

- No min. credit score

- $10,000 min. monthly revenue

- 1 yr. min. time in business

Data as of post date. Offers and availability may vary by location and are subject to change.

Do you have one of the many businesses that uses Square to process credit card payments? Then you’re in luck―you might qualify for Square Loans.

Square offers loans to qualified users―basically users that have consistently processed a good volume of credit card payments through its service. That means Square doesn’t care about your overall revenue or your credit score. Just your Square processing history.

Unfortunately, Square doesn’t let you manually apply for a loan. If you don’t see an offer, you don’t qualify (yet). That makes Square Loans hard to plan for. But if you do get an offer, Square loans give you a convenient way to fund your startup.

Payability: Best for ecommerce sellers

- No min. credit score

- $10,000 min. monthly revenue

- 3 mos. min. time in business

Data as of post date. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

For businesses that sell on ecommerce marketplaces (like Amazon, Walmart, or Shopify), Payability can offer accessible startup funding.

Payability gives cash advances to qualified sellers. It looks at your sales history (with whatever platform you use). If you have a history of good sales, you can qualify―simple as that.

Note that Payability does expect a fairly high amount of revenue, though. And as with any cash advance, its funding costs a lot. At least it lets you save on fees by repaying your advance early.

Forward Financing: Best customer reviews

- 500 min. credit score

- $10,000 min. monthly revenue

- 1 yr. min. time in business

Data as of post date. Offers and availability may vary by location and are subject to change.

Forward Financing offers just merchant cash advances, but it gets incredible customer reviews.

In fact, Forward Financing consistently gets the highest reviews of any lending company we review. Its customers say Forward Financing is fast, easy to use, and has great customer service. All good stuff.

We still see downsides, though, like high (and hidden) costs. So despite what customers say, Forward Financing wouldn’t be our first choice for funding. If those downsides don’t worry you, though, Forward Financing reviews suggest you’ll have a good experience.

The takeaway: Best start-up loans for small business

Even as a startup business owner, you have plenty of financing options.

With Lendio’s lending marketplace, you can compare funding offers and find the best deal. Or you can apply directly with Bluevine to try for low interest rates. Very young businesses may prefer applying with Fundbox. Borrowers with plans for the future might want to start a relationship with OnDeck. And business owners wanting the cheapest possible deal can enjoy 0% interest form Kiva.

So find the lender that fits your needs and qualifications the best, and then get that funding to grow your business.

Now that you’re reading to apply for a startup loan, make sure you avoid common mistakes when getting a business loan.

Startup loan FAQ

You may have a hard time getting a loan for your startup. Lenders prefer to loan money to older businesses with high revenue. If you’ve got a young business (less than a year old or less than $100,000 in revenue), you may consider a personal loan, business grant, or crowdfunding instead.

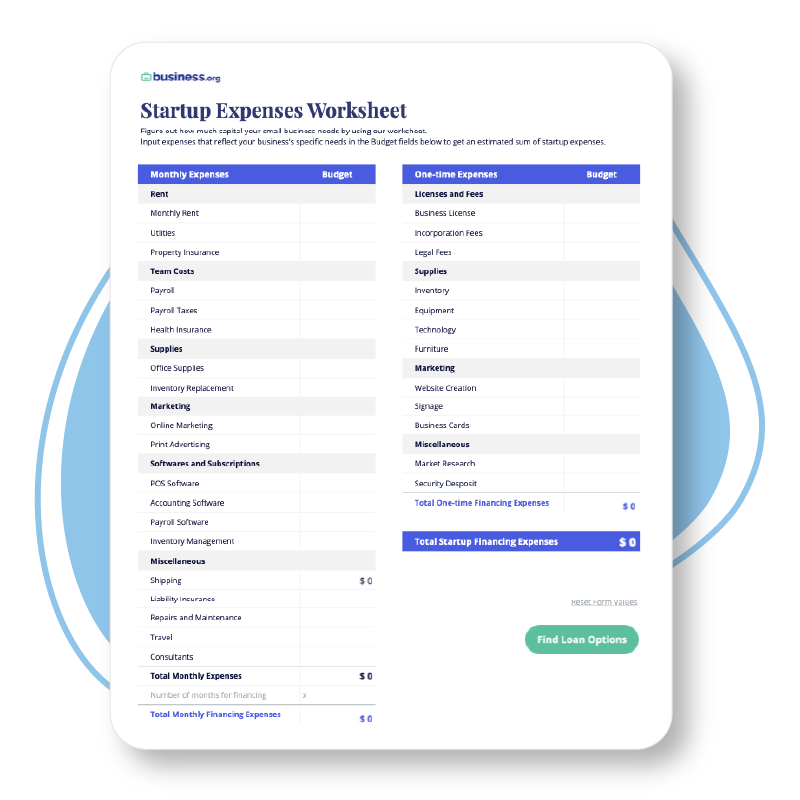

When applying for a business loan, you’ll typically need at least one year in business and up to $150,000 in annual revenue. Other business loan requirements include:

- Personal credit score (620 or higher is preferred)

- Profit and Loss statements

- Balance sheets

- Bank account records (including current debt)

- Tax returns for the past two years

The best loans for starting a new business depend on your credit score and the loan amount you're looking for. Bluevine is best for low starting interest rates and Funcbox is best if you have poor credit and need to borrow $150,000 or less.

Our methodology

We evaluated over 50 traditional and online business lenders, focusing our search on those that lend to young businesses (one year or younger) with limited revenue (under $150,000). After narrowing things down, we graded the remaining lenders on financing costs, accessibility, customer reviews, and more―and the resulting scores gave us our rankings.

Related reading

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.