We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Best Tax Software for Small Businesses in 2025

Data as of 1/11/23. Offers and availability may vary by location and are subject to change.

Are you hoping to tackle 2023 taxes like a champ? Small-business tax software can minimize tax season stress while maximizing your tax return. Our top tax software for small businesses is TurboTax, Intuit's popular tax-filing software, but it's not the only option. Check out Business.org’s picks for the year’s best tax software options below.

- : Best budget option

- : Best overall

- : Best for small business

- : Best for beginners

- : Best for complex businesses

By signing up I agree to the Terms of Use and Privacy Policy.

Compare the best small business tax software

Data as of 1/11/23. Offers and availability may vary by location and are subject to change.

FreeTaxUSA: Best budget option

Data as of 1/11/23. Offers and availability may vary by location and are subject to change.

FreeTaxUSA’s appeal is obvious from its name alone: With FreeTaxUSA, you can file your federal taxes for free, and a state return costs just $14.99. The Deluxe upgrade adds a few features, like amended returns and priority support, for $7.99.

And the additional features you get for exactly zero dollars aren’t half bad either. For instance, the software lets you integrate previous tax return information, offers email-based customer support, and accounts for over 350 credits and deductions. But since the software is free, you’re still looking at fewer benefits than you’d get with Liberty Tax or H&R Block. As a result, FreeTaxUSA works best for freelancers and sole proprietors.

TurboTax is one of the most popular tax software options for a reason (well, several). For starters, the software walks you through every step of the tax-filing process, asking clear questions and pointing you toward often overlooked tax deductions. The clean interface speeds up tax filing, and TurboTax’s maximum refund guarantee gives you some extra peace of mind.

That said, the features and reliability definitely come with a cost—especially if you wait until the end of the tax season to file, when TurboTax’s prices tend to jump. Currently, TurboTax Premium starts at $129 for federal taxes and $59 per state. If you’re a member of a partnership, S Corp, or C Corp, you’ll want TurboTax Business, which starts at $190 for federal plus $55 per state.

- Outsource your bookkeeping. Merritt Bookkeeping's affordable outsourced bookkeeping saves business owners time and money.

- Opt for all-in-one business checking. Found is the perfect match for teams of one looking for smart tax tools.

- Get better accounting software. Quickbooks is our top pick for businesses looking for comprehensive features that simplify tax season.

E-file.com: Best for multi-state businesses

Data as of 1/11/23. Offers and availability may vary by location and are subject to change.

Sure, E-file.com’s low federal filing starting price is a perk—but where the software really soars is in state tax filings. Unlike big-name competitors like H&R Block and TurboTax, E-file.com charges one flat price for unlimited state tax filings.

So how affordable are we talking? Small-business owners should buy the Premium edition, which normally costs $37.49 for federal filings with state returns costing $22.49. With E-file.com, you can’t file a Form 1120 for corporations from the site. If your business is registered as a C corporation, you’ll need a different tax software provider. But smaller businesses score a solid value with E-file.

Liberty Tax: Best for beginners

Data as of 1/11/23. Offers and availability may vary by location and are subject to change.

Seen Lady Liberty twirling a sign on a sidewalk recently? That’s Liberty Tax. Like H&R Block, Liberty Tax combines brick-and-mortar storefronts with online offerings—a great perk for new business owners who might want face-to-face help untangling tricky tax situations. Plus, Liberty Tax’s Tax Education School offers online and classroom tax courses. If you’re a brand-new business owner, these courses can help you gain tax know-how to save time and money the next time tax season rolls around.

If you’re self-employed, you’ll need Liberty Tax’s Premium plan, which starts at $85.95 for federal tax filing plus $36.95 per state.

H&R Block: Best for complex businesses

Data as of 1/11/23. Offers and availability may vary by location and are subject to change.

H&R Block is a popular company with plenty of experience—it’s been around for over 60 years. And while it doesn’t offer the cheapest software, it’s a tad cheaper than TurboTax with all the same guarantees. H&R Block also has hundreds of locations all over the country. If you decide halfway through filing taxes that they’re too complicated to tackle on your own, you can always call your local branch and decide on next steps with a certified accountant.

H&R Block’s additional features include the following:

- Quick, easy integration of past tax return info (even if it’s from a competitor’s software)

- Free in-person audit representation if needed

- Live chat help with a tax professional (available at an additional cost)

H&R Block starts out a little cheaper than TurboTax: its software for self-employed business owners costs $84.95 for federal filing plus $36.99 per state filing.

Honorable mention: TaxAct

Data as of 1/11/23. Offers and availability may vary by location and are subject to change.

TaxAct is the Toyota Corolla of tax software: affordable, straightforward, and well-rounded. You can expect all standard features—plus a few bonuses—with the TaxAct software, including integration with previous tax data, one-on-one help from tax experts (over the phone), and accounting software integration.

As a solid middle-of-the-road option, TaxAct gives business owners options like accountant support without overwhelming you with the bells and whistles of more comprehensive (and more expensive) software. TaxAct helps you file a single federal return for $64.95. State tax returns cost an additional $44.95. Even larger businesses, like a C corporation or S corporation, pay the same cost.

The takeaway

We doubt most business owners would refer to tax season as a breeze. But with the right tax software, tax-filing season becomes less stressful for sole proprietors, employers, and freelancers alike. Instead of stressing about tax filing, let your software take the front seat while you spend more time doing what you love: focusing on your business.

Want a little more info on filing small business taxes before you dive into software? Check out our guide to filing taxes as a small business for even more tips.

Related content

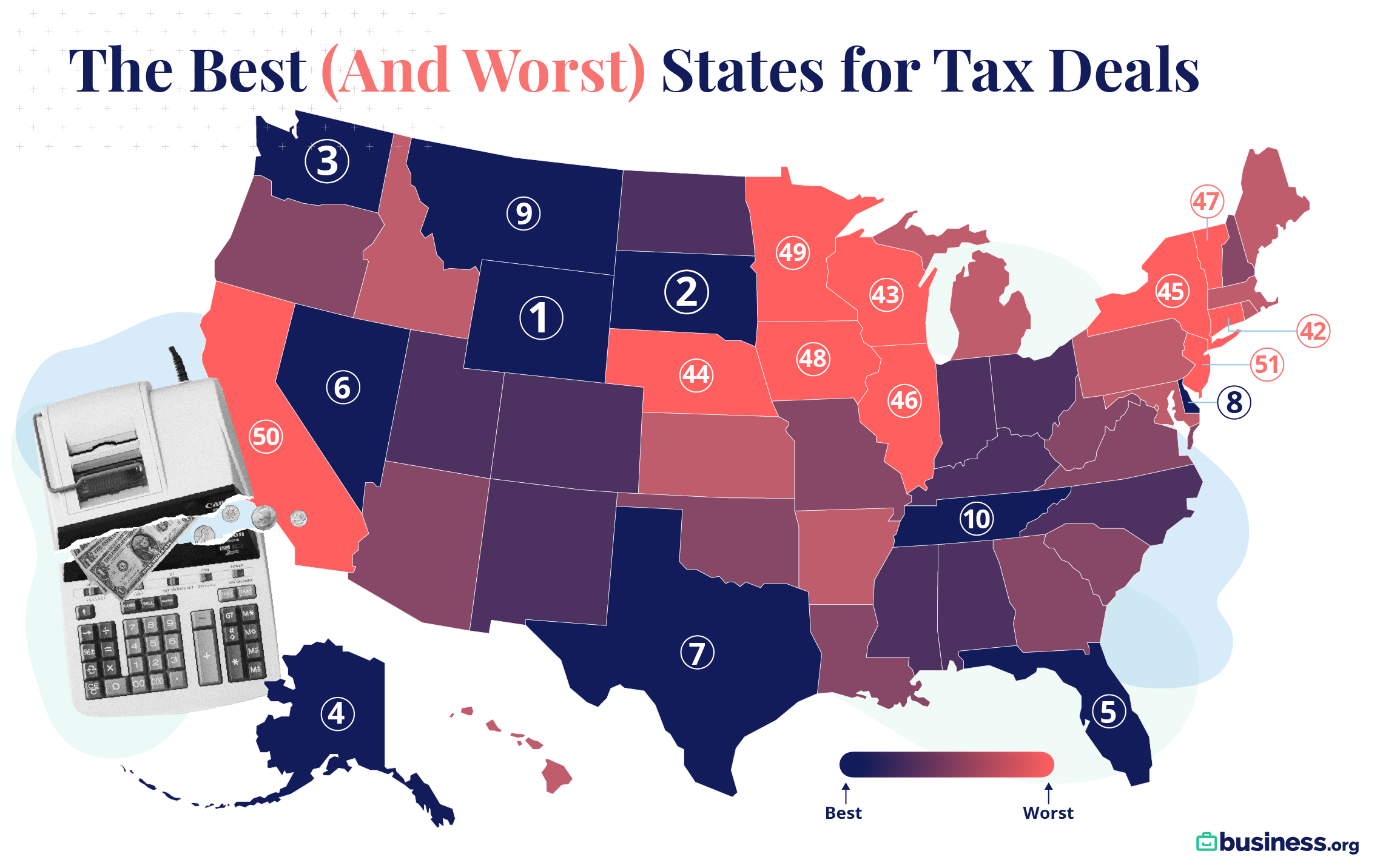

The Best (and Worst) States for Small Business Tax Deals

Thanks to the government’s recent tax-filing extension, the tax deadline isn’t quite around the corner—but it’ll still arrive sooner rather than later. Whether you have or haven’t filed yet, we hope you’re in for a substantial return. But since tax laws vary drastically from state to state, the place you choose to set up shop can influence your business’s growth, success, and sustainability.

How? Well, for starters, seven of our top states lack a state income tax, and one, Tennessee, has just a 1% rate. Some, like Washington, are famous for their startup culture and tech friendliness; it’s practically a given that their tax laws would incentivize small business owners. Other winners, like South Dakota and Montana, are rural states where the cost of living is low—and so is the cost of starting a business, which makes the area enticing to small-business owners, individuals, and families alike.

In contrast, our lowest ranked states have notoriously high taxes and high costs of living, especially California and New York. The lack of tax deals might make them less appealing to business owners who are trying to make money, pay their employees, send in the rent check on time, and, you know, eat the occasional meal or two.

Your taxation situation

Of course, while location is crucial to your tax prospects, it isn’t the be-all and end-all of tax deals—or of business success. State business taxes often break down by industry, so you’ll want to do more research before planning your immediate move from Minnesota to Wyoming. Still, if tax deals are important to your business, give our top picks an extra look; a good tax bargain can nudge your business in the right direction.

Top 10

Bottom 10

Methodology

To determine the best and worst states for business tax deals, we looked at four tax rates in each state:

- State income tax rate (weighted 40%)2

- Combined state and federal corporate tax rate (weighted 20%)3

- Combined state and local sales tax rate (weighted 20%)4

- Property tax rate (weighted 20%)5

We weighted each rate and assigned the states’ scores based on how high or low their tax rates were. Specifically, we normalized each measurement on a 0–1 scale with 1 as the measurement that would most positively affect the final score and 0 as the measurement that would most negatively affect the final score. These adjusted measurements were then added together with the weights mentioned above to get a score of out of 100.

Sources

1. E-file.com, “Income Tax Return, eFile Statistics,” June 1, 2020. Accessed January 11, 2023.

2. Katherine Loughead and Emma Wei, Tax Foundation, “State Individual Income Tax Rates and Brackets for 2019,” March 20, 2019. Accessed January 11, 2023.

3. Garrett Watson, Tax Foundation, “Combined State and Federal Corporate Income Tax Rates in 2020,” January 31, 2020. Accessed January 11, 2023.

4. Janelle Cammenga, Tax Foundation, “State and Local Sales Tax Rates, Midyear 2021,” February 3, 2022. Accessed January 11, 2023.

5. World Population Review, “Property Taxes by State 2022.” Accessed January 11, 2023.

Tax software FAQ

No. If you’re self-employed, a sole proprietor, or a freelancer, you cannot file your business and individual taxes separately. Instead, you’ll file your business’s tax returns alongside your personal tax return. That’s what a Schedule C Form is for—this form attaches to your personal tax return (Form 1040) and details your business’s profits and losses for the tax year.

If you’re a self-employed business owner or freelancer, the federal government requires you to file taxes quarterly if you expect to owe more than $1,000 in federal taxes. And if you pay employees, then you’ll also need to file Form 941 quarterly. (This form is for reporting and remitting payroll taxes to the IRS.) Finally, if you sell tobacco, alcohol, gasoline, or other products that require an excise tax, you’ll file Form 720 quarterly as well.

What forms do I need to file business taxes?

Different business entities each use different tax forms—we’ll give you a quick rundown.

If you’re self-employed and your small business isn’t registered as a legal entity, you should fill out a Form 1040, which is your personal tax return. As part of your 1040, you’ll also need to complete the Schedule C portion, which allows you to report the income and expenses from your sole proprietorship. These same forms will also work if you registered your business as an LLC with you as the sole member.

Every member of a partnership, LLC, or S Corporation needs to fill out Form 1065 and a Schedule K-1. Each of these business organizations pass through business income to the owners or shareholders, so the members will need to account for those earnings under Schedule E in their personal income taxes.

Unlike the organizations above, C Corporations do not pass through income to the business owners. These businesses file their corporate taxes using Form 1120. If you’re a business owner, you should get a Form 1099 to inform you of the income you made from the business for your personal return.

Methodology

Given the immense liability involved in sending cash every year (or quarter) to Uncle Sam, we carefully analyzed each tax platform's data privacy practices, accuracy guarantees (if any), ease-of-use, ability to handle complex tax situations, value for the money, and other nuanced features.