We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

From Employee to Entrepreneur: 8 Steps for Transitioning to Self-Employment

Syndicated from The Penny Hoarder

Freelancing, consulting or starting your own business could be the perfect way to launch the career of your dreams.

But making the jump to self-employment is never easy. Leaving behind the comfort and security of your day job in exchange for the massive responsibility of running your own business is exciting — but totally nerve-wrecking.

By signing up I agree to the Terms of Use and Privacy Policy.

8 steps for transitioning to self-employment

If you’ve been an employee for years, it’s tough to know where to start. Here are some important tips to keep in mind during your self-employment journey.

1. Develop a business plan

One of the first steps in transitioning to self-employment is writing a business plan.

Your business plan should outline your goals, the services or products you’ll offer, your target audience and your financial projections.

Ask yourself these questions when creating a business plan:

- What services will you offer?

- Who is your target audience and how will you reach them?

- How will you land your first contract or project? How will you find future clients and leads?

- How will you price your products or services?

- How much revenue do you need to cover expenses?

- When and where do you want to work?

- How will you grow your skills and network?

You can also check out this free 30-minute course on how to create a business plan from the Small Business Administration.

When developing your plan, be realistic about your financial projections and set achievable goals. Don't underestimate the time and resources required to get your business up and running.

This is also a good time to determine what makes your skills or service unique. How will you differentiate yourself from competitors and position yourself as an expert in your field?

2. Create wiggle room in your current job

You can work toward your new freelancing career even before you leave your old job — in fact, this is advised by most career experts.

You’re likely spending more time than necessary doing work you don’t like in your current position. Start your transition by trimming the fat.

Figure out what tasks should be completed by subordinates or other departments, and get them off your plate.

Cutting out the mundane aspects of your job, like team-wide meetings and performance reviews, can free up more time to focus on your own business.

Start to grow your side hustle, working with a few clients and gigs in the time you’ve freed up so you can replace your income and transition your work and lifestyle slowly.

Your side hustle will probably take over your free time and other hobbies for a while. But it will pay off when you’re able to leave your day job behind, start a new career and do what you love.

Need some start-up money? Here’s how to get a small business loan.

3. Get your finances ready

Aim to save three to six months' worth of living expenses in an emergency fund, plus whatever capital you need for the business.

This financial cushion will give you some breathing room if you hit unexpected expenses or a slow month.

Start saving by looking for ways to cut expenses and identify ways to save money fast, like canceling subscriptions and shopping for cheaper car insurance quotes.

Use an expense tracking app so you can identify areas where you can cut back and save more money.

By preparing yourself for life at a lower income, you can remove the financial fear that comes with quitting your day job.

Now is also a good time to take care of big expenses. Upgrade your computer, pay off credit card debt and eliminate as much other debt as possible while you can still rely on your current income.

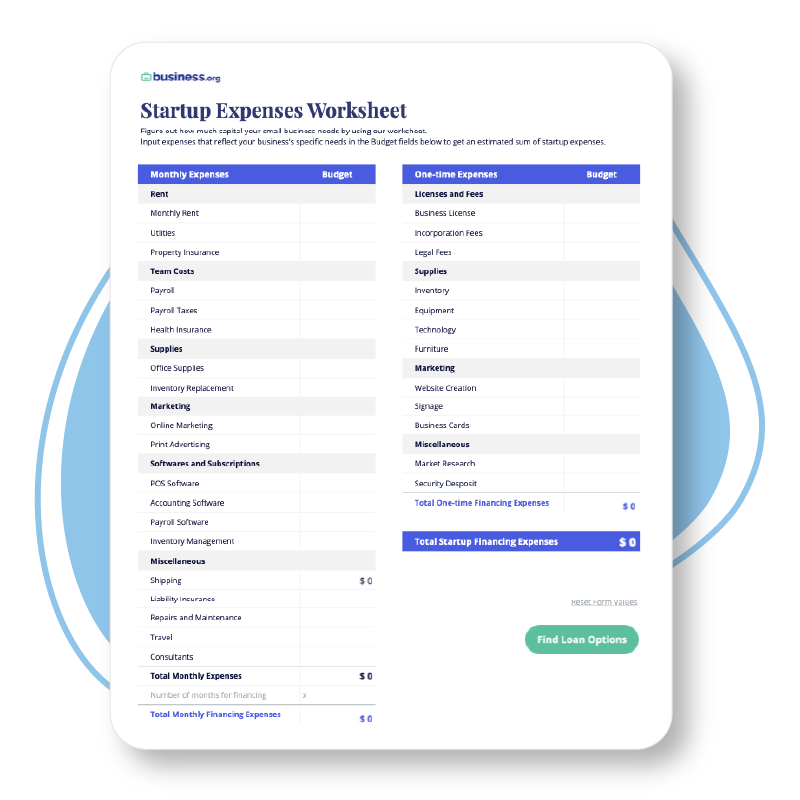

You also need to figure out how much money you need to start your business and how you will finance it: Personal savings, small business loans or private investors.

Calculate how many hours per day and per week that you need to work in order to meet your financial goals and replace your current income.

Don't expect to make a full-time income right away and be prepared to work hard and stay committed.

Finally, create separate accounts for your business and personal finances. This makes it easier to track your business income and expenses for tax purposes. Keeping things separate also helps avoid a mix up between your personal savings and your business cash reserves.

Compare the Top Small-Business Banks

Data effective 4/20/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

4. Figure out your health care and taxes

Launching your own business means you’ll be responsible for many expenses currently covered by your employer, including taxes and health insurance.

Unlike traditional jobs, self-employed individuals are responsible for paying their own taxes. A good rule of thumb is to set aside about 20% to 35% of every paycheck you make to cover your self-employment taxes.

You’ll need to pay estimated taxes each quarter in addition to filing an annual tax return. This will include both federal income tax and self-employment tax, an additional tax levied on independent contractors currently totalling 15.3%.

Before you transition to self-employment, sit down with a certified public accountant. This professional can help set-up your accounting processes and tax reporting. A CPA can also assist in helping you create realistic billable rates.

Taxes are complicated. Check out our guide on how to file small business taxes to learn more.

Next, you’ll need to figure out your health insurance. Buying your own coverage can be costly, but luckily, there are a few ways to get health insurance if you’re self-employed.

You can purchase a plan through the Affordable Care Act (ACA) Health Insurance Marketplace. Here, you can compare health insurance from a variety of providers — and you may be eligible for subsidies based on your income.

Additionally, you can look into getting health insurance from your spouse’s employer. Or maybe you can continue working part-time for your current employer to keep your benefits in place.

5. Network and learn

Use this time before leaving your full-time job to educate yourself about freelancing and your new industry.

Continuing education and professional development are key to staying competitive in today’s job market.

Attend workshops and conferences, take online courses and read industry publications to stay up-to-date with business trends and best practices.

Networking is also key. It’s crucial to start building relationships before you make the transition to self-employment.

Learn how to utilize your resources, and find new ones. Join your local chamber of commerce, reach out to the Small Business Administration and connect with colleagues on social media.

Work to add more people to your support network over time, whether that's a mentor, a business coach or a meet-up of fellow entrepreneurs.

You don’t need to be a social butterfly to thrive at networking events. These networking tips for introverts can help.

6. Embrace time management

As a self-employed individual, you’re responsible for managing your own schedule, finances and client relationships.

It’s important to stay organized in your business and keep track of your to-do list and deadlines.

Learning how to track your time will make it easier to calculate your billable hours, create reports and conduct a proper cost/benefit analysis. It’ll also help you get time back from your business.

Consider using tools like project management software, accounting software and time-tracking apps to stay on top of your workload.

Using a timesheet calculator or a similar app for a few weeks can provide insight into your biggest time wasters, as well as your most productive hours.

7. Make the jump … gracefully

When the time comes to part ways with your job, give proper notice and maintain a positive relationship with your employer.

After all, you never know when you might need a reference or want to work with the company again on a part-time or contract basis.

Before calling it quits, review your employment contract to identify any non-compete or non-disclosure agreements you may have signed.

Don’t let these documents stop you, though.

Be proactive and let your employer know that you won’t solicit their clients. If you’re honest and objective, your employer is less likely to enforce a NDA or non-compete.

8. Know what’s holding you back — and let go of those fears

Sometimes fear is the biggest thing holding people back from transitioning to self-employment.

You have the passion and the ability to acquire all the skills and knowledge you need to do what you want. Hurdles in your life may make the transition difficult — a family who needs your time and attention, a day job that leaves you exhausted, a mortgage that insists on being paid each month.

But none of these challenges make your dream impossible.

Be prepared for the ups and downs of entrepreneurship and have a plan in place for dealing with setbacks and challenges.

Then take a deep breath and jump.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer at The Penny Hoarder. She focuses on retirement, investing, taxes, and life insurance.

Want affordable banking with great perks? With Bluevine, you can get a fee-free business checking account―and you can even earn up to $5,000 in interest.