We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Santander Business Banking Review 2025

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

Santander isn’t the most popular bank out there. That’s in part because it’s not widely available (it’s only in eight states)―but the high account fees and bad customer reviews probably don’t help either.

Still, Santander offers more checking account options than many banks, with waivable months fees on all of them. It even has some interest-bearing checking options. So Santander might still win your heart (or at least your business).

With any luck, our review will help you decide. We’ll tell you all about what bank accounts and other products Santander has to offer, how it compares to other banks, and more.

Santander bank accounts and pricing

You’ll find both business checking accounts and business savings accounts at Santander—though you get more choices for checking than savings.

Checking accounts

Santander has quite a few checking accounts to choose from. Unlike most banks we’ve seen, Santander splits its accounts into two categories: small-business checking accounts and business banking checking accounts.

As far as we can tell, the two types don’t have different application criteria, but the small-business accounts are probably best for (surprise) smaller, younger businesses. Let’s start with those.

Santander small-business checking accounts

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

Business Checking has a $10 monthly maintenance fee, but it gives you up to 300 free transactions and cash deposits. You can waive your monthly fee in one of several ways:

- Keeping an average balance of $5,000 in your Business Checking account

- Maintaining a $10,000 balance across your business deposit accounts

- Making three or more purchases with your business debit card

- Having a merchant services payment deposited into your account

- Paying $50 or more in account analysis fees

Business Checking Plus charges the highest monthly fee of Santander’s small-business checking accounts, but it gives you the most free transactions and cash deposits—so it might be worth it. You can, of course, waive the monthly fee. This is another account with several options for doing so:

- Maintaining a $40,000 average daily account balance

- Keeping at least $60,000 across your various business deposit accounts

- Getting a merchant services payment deposited into your checking account

- Paying $50 or more in analysis fees

Then there’s Santader’s Banking Analyzed Checking account. Santander doesn’t publish many details on this account. But you can expect that, like all analysis checking accounts, it gives you earnings credits based on your account balance. So while you don’t get any free transactions or deposits, you can offset your fees by keeping money in the bank.

And finally, Santander has some specialty business checking accounts, like these:

- IOLTAs

- IOLAs

- IOTAs

- IOREBRTAs

- Escrow Master/Sub Relationship

- Escrow Standalone Savings

(Don’t know what those are? Don’t worry. They’re required for some types of businesses, like lawyers and mortgage brokers. If you needed one, you’d know it.)

By signing up I agree to the Terms of Use and Privacy Policy.

Savings accounts

While Santander offers a good variety of checking options, its business savings accounts are pretty limited. No standard savings or certificates of deposit (CDs) here—just a money market savings account.

Santander small-business savings accounts

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

The money market account lets you waive your monthly service fee with a $1,000 minimum daily balance. You can also get the fee waived if you have a Santander small-business or business checking account.

While Santander advertises a mediocre 0.05% APY (annual percentage yield) for your first six months (and only for balances of at least $50,000), it doesn’t list the usual rates on these accounts. With a promotional rate like that, we expect its everyday rates to be pretty low.

Santander features

Now that we’ve shown you Santander’s bank accounts, let's talk about what we like about them.

For starters, Santander does offer quite a few checking account options. While other banks (especially online banks) often offer just one or two checking accounts, Santander’s got five options for most businesses plus specialty accounts for lawyers and brokers. That’s not bad.

Among those checking accounts, Santander offers both interest-bearing checking and analyzed checking. Those can be super cost-effective for businesses that keep large account balances.

Analyzed checking is a type of deposit account that gives you earnings credits for high account balances. These accounts charge you for each transaction and deposit, but if you have a high enough balance, you can offset those fees completely.

And a bonus: Unlike most other banks with robust analyzed checking options, Santander isn’t embroiled in huge scandals.

Speaking of other banks, let’s look at how Santander stacks up against the competition.

Santander vs. other banks for business

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

As you can see, Santander isn’t nearly as widely available as other traditional banks―and definitely not as available as online banks.

Still, it does have lower starting monthly fees than lots of traditional banks. But online banks definitely beat out Santander with their lack of monthly fees.

As far as other fees go, Santander accounts tend to have higher fees and fewer freebies than accounts from other traditional banks. And of course, plenty of online banks offer no-fee checking―certainly cheaper than Santander.

Drawbacks

So at this point you may have noticed we don’t exactly rave about Santander. And you’ve probably already seen plenty of reasons why―but let’s get it all out in the open.

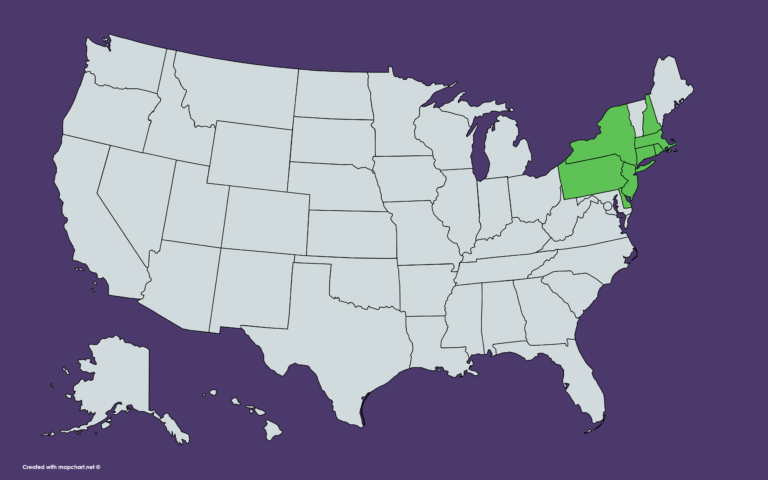

First things first, let’s be clear: Santander is one of the more geographically limited banks out there. If you’re not one of eight New England states, you’re out of luck (in which case we recommend finding the best bank for business in your state instead).

Santander availability

But let’s assume you’re in one of those states, since you’re still reading this. Should you do your business banking with Santander?

For most businesses, we’re going to go with no. Santander has pretty poor customer reviews (a measly 1.4 out of 5 on Trustpilot1, which we’ll talk about more in a minute). Its bank accounts, as we’ve said, aren’t that competitively priced. And frankly, most New England states have plenty of other banking options.

If you’re still on the fence, though, we understand. So we’ll go ahead and tell you about the rest of the stuff Santander can do for your business.

Other small-business products and services from Santander

Santander has a few other things to offer business owners, though it doesn’t have quite the broad selection that some bigger banks do.

Small-business financing

Santander has just a handful of business funding options. But with the versatility offered by lines of credit, term loans, and equipment financing, they should work well for many business owners.

Compare Santander’s small-business lending

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

To qualify for business loans through Santander, your business will need to be at least two years old. Santander doesn’t publish other application criteria. But since it’s a traditional bank, you’ll probably need a healthy annual revenue (think $250,000 or more) and a strong personal credit score (like 740 or higher).

In return, you’ll get long terms and—with any luck—low rates. Again, Santander doesn’t advertise its interest rates, so we can’t say for sure. But as a general rule, traditional banks offer very competitive rates to qualifying businesses.

Santander is an SBA-approved lender, so you can also get various types of SBA loans there.

Miscellaneous

- Merchant services

- Cash management (deposits, lockboxes, etc.)

- Currency exchange

- Global trade solutions

Santander customer reviews

Santander doesn’t have the best customer reviews―but it doesn’t have the worst reviews either. Santander has a 1.4 (out of 5) on Trustpilot and a 3.2 (also out of 5) on Bank Branch Locator.1,2

Most complaints seemed to be about poor customer service. A few people complained about sketchy overdraft fees, but we didn’t see trends of customers accusing Santander of fraud or anything (unlike some big banks).

We did see some reviews complaining that Santander makes it unreasonably difficult to open a bank account—and especially a business bank account. So if you’re hoping to start banking immediately, you should probably go elsewhere. (Perhaps an online bank for business?)

The few positive reviews we saw had kind words about Santander’s customer service, both at local branches and in its fraud department. So you do have a shot at having a positive banking experience with Santander.

The takeaway

So is a Santander deposit account right for your business?

It might be, if your business is in New England—and if you plan to have high enough account balances that analyzed checking or interest-bearing checking make sense for you―or if you need one of its speciality bank accounts.

Otherwise, you might find other banks offer better value, are more widely available, and get better reviews.

Want to find an alternative to Santander? Check out our list of the best banks for small business.

Related reading

Methodology

We scored Santander on many different factors, from the number of states it operates in to its account options and costs to its customer reviews. Those scores helped us review Santander and compare it other banks for business.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Sources

- Trustpilot, “Santander.” Accessed November 10, 2021.

- Bank Branch Locator, “Santander Bank.” Accessed November 10, 2021.