We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

TD Business Banking Review 2025

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

TD Bank offers business checking and savings accounts to business owners—plus a whole lot more. Businesses in certain East Coast states can enjoy TD Bank’s longer banking hours (compared to other banks) and its many banking options.

But if you’re not in one of the 15 states TD Bank does business in―or you want a bank with great customer reviews―then TD Bank probably isn’t right for your small-business needs.

Need more details? We’ll dive into all that―and more―in this TD Bank review.

Compare TD Bank banking accounts and pricing

So you think TD Bank might be right for you, but you’re not positive yet. No problem. Let’s break down its business bank accounts to see if it offers what you need.

Checking accounts options and fees

While TD Bank didn’t top our list of the best banks for small-business checking, it was an honorable mention. Its fees are competitive, though not the best we’ve seen. Of course, the exact fees you pay will depend on which checking account you get. You have four to choose from.

TD Bank small-business checking accounts

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

Business Simple Checking has the lowest opening deposit and monthly fee, but that doesn’t necessarily make it the cheapest. It’s the only checking account that doesn’t have an option for waiving the monthly fee, and it has higher transaction fees than other accounts. But if you plan on maintaining a low account balance—too low to waive the monthly fees on other accounts—this could be your best option.

Then there’s Business Interest Checking Plus, TD’s interest-bearing checking. You can waive its monthly fee with a $2,500 daily balance, and you’ll get lower transaction fees than with Simple Checking. But the APY on this account is pretty disappointing (0.05% compared to Bluevine's 2%), and you get only 200 free transactions a month. Still, if you just want to earn a few extra dollars with checking, this account works.

With Business Convenience Checking Plus, you can waive the maintenance fee by keeping a $1,500 minimum, spread between your TD business account and your TD personal checking account. That’s a lower balance than the Interest Checking Balance Plus account, and you get more free transactions with this account too—making this a great option for most businesses.

Business Premier Checking gives you the most free transactions and deposits, plus lower transaction fees—but it has the highest monthly fee, and waiving it will cost you, no matter which waiving qualifier you choose. You can maintain a minimum balance of $40,000 between your business account and personal checking account, use TD’s merchant solutions, use the TD Digital Express check scanner, or have an active business loan from TD Bank. If you’re doing any of those things anyway, this account is the obvious choice. Otherwise? You’ll probably get a better deal on a cheaper account.

Savings accounts options and fees

Need more than just a checking account? No worries—TD Bank has options for business savings too.

TD Bank small-business savings accounts

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

The Business Savings account provides a low-cost option for squirreling away your business funds, but it doesn’t allow you to use checks. Plus, savings accounts usually have a lower APY than money market accounts. So while the Small Business Money Market Plus account costs a bit more, it’s worthwhile for businesses that intend to maintain a larger account balance.

Want to know more about your business savings options? We have a guide to the differences between savings, money market accounts, and CDs.

But if you really want to maximize your business savings at TD Bank, take a look at its certificates of deposit (CDs).

TD Bank small-business CDs

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

Unfortunately, TD Bank has dropped the interest rates on its certificates of deposit. If you want more competitive rates, NBKC Bank offers CDs with a much higher APY.

That said, TD Bank has some of the most flexible CD options we’ve seen, with terms that range from as short as one week to as long as five years. So whether you want to save (relatively) little or a lot, TD has a CD for you.

Just remember that CDs don’t really let you touch your money—at all—for the duration of the term. TD does offer No-Catch CDs that give you one penalty-free withdrawal per term. But if you really need access to your money, we suggest a money market account instead.

By signing up I agree to the Terms of Use and Privacy Policy.

TD Bank’s flexible business hours

Now you know all about TD bank accounts. But let’s get back to that other reason business owners will like TD Bank: extended hours.

Most banks are open Monday through Friday, 9 to 5—not ideal if you’re running a business during those same hours. But TD isn’t most banks.

For starters, TD Bank stays open on some holidays when other financial institutions don’t. On President's Day, Columbus Day, and Veterans Day, you can do business as usual at TD Bank.

More importantly, TD Bank branches have wider hours on any given week than most of the competition does. While the exact hours vary from branch to branch, we saw locations that opened at 8:30 a.m., locations that closed at 6 p.m., and locations that were open on Saturday and Sunday.

So even if you run your business during a typical 9-to-5 workday—or if your retail business is open every day and you need to make deposits or get change on the weekends—you’ll have time to bank with TD.

Plus, TD gives you options for banking both in person and online. Yes, TD Bank is ultimately a traditional brick-and-mortar bank. You’ll need to visit a branch sometimes (to open most accounts or take out a loan, for example). But TD offers enough online and mobile banking features that you can pay bills, make cash transfers, and check account balances from the comfort of your home or business at whatever hours you please.

TD Bank is dog-friendly. Go ahead, bring your chief barketing officer along for a treat.

Compare TD Bank vs. competitors

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

While TD Bank offers tons of flexibility, it doesn’t always match the affordability of other business bank accounts.

Compare TD Bank to other physical banks, for example. It’s one of the few to not offer a free business bank account (with no monthly fee).

But the difference becomes even starker when you compare TD Bank to online banks, like Bluevine and Kabbage. Those banks offer totally free business checking (no monthly fee, no transaction fees, and so on).

So if you don’t mind a mostly online experience, online banks might be able to give you a better deal. But if you prefer in-person banking, you’ll have to weigh TD Bank’s slightly higher starting costs with the more limited availability of other banks.

TD Bank of drawbacks

Aside from the costs we just talked about, TD Bank has two big downsides you need to know about: its availability (or lack thereof) and its customer reviews.

TD Bank availability

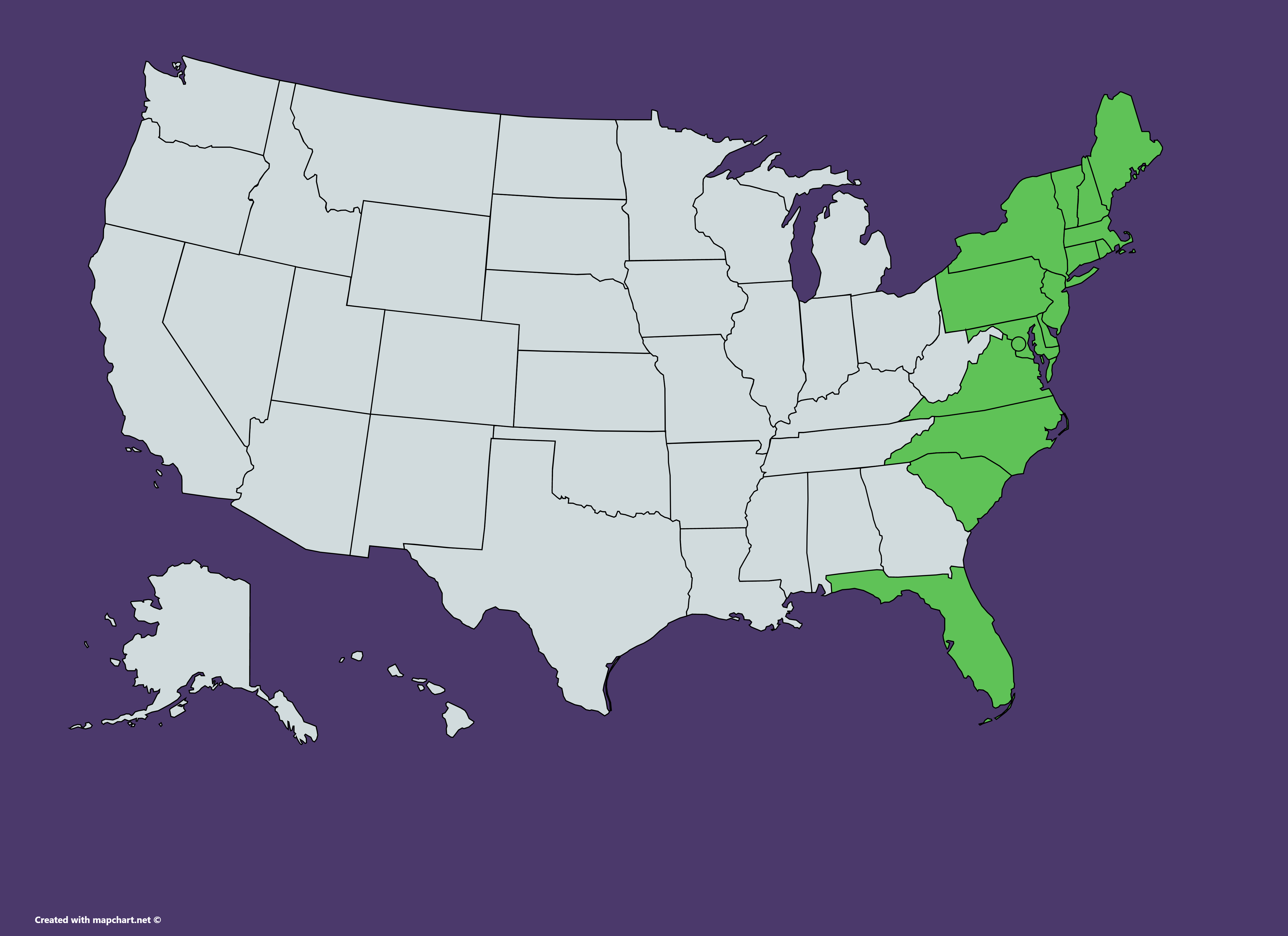

Like many physical banks, TD Bank doesn’t operate in all 50 states. But TD Bank has more limited geographical reach than many states. It offers banking in just 15 states, plus the District of Columbia:

As we said earlier, TD really only works for East Coast businesses.

(If TD Bank doesn’t do business in your area, you can check out our guide to the best bank for business in your state to find an alternative option.)

TD Bank customer reviews

While TD Bank has a lot to offer, actual TD customers don’t necessarily love all those offerings. While it doesn’t have terrible customer reviews, TD Bank reviews aren’t especially positive either. To get specific, TD Bank has a 1.3 (out of 5) on Trustpilot and a 2.9 (out of 5) on Bank Branch Locator.1,2

Those mediocre scores are an average of really positive and really negative reviews, with very little in between.

Pretty much all the reviews are about specific branches. Some people say the staff at their local branch go above and beyond to help customers, while others say the staff at their local branch are rude and unhelpful. In other words, your specific experience will largely depend on who works at the branch near you. That makes banking with TD Bank a bit of a gamble―but one that could potentially pay off.

Compare TD Bank’s small-business lending

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

TD Bank offers term loans and lines of credit to its small-business customers. While it might not be one of our favorite lenders, you might find that getting a loan through your bank gets you good deals. Traditional banks usually have very low, competitive interest rates on their financing―much lower than you can get from online lenders. And while TD Bank doesn’t list its interest rates, we expect that to hold true for its loans.

(And as mentioned above, getting a loan from TD Bank can waive the monthly service fee on its premium business checking account.)

We also wanted to point out that TD Bank offers government-backed loans, including both SBA loans and USDA business loans. In fact, TD Bank is an SBA preferred lender, which means you can get through the notoriously long SBA loan application process faster.

Just remember that banks like TD usually have fairly high borrower requirements. You’ll likely need a credit score in the high 600s, revenue over $100,000, and a business that’s at least two years old to qualify for a business line of credit or loan.

Small-business credit cards

Even if long-term financing isn’t your thing, you can still consider getting a business credit card from TD Bank. The TD Business Solutions Credit Card has 1% to 2% cash back rewards for various purchases, and there’s no annual fee.

Merchant services

Does your small business sell stuff or get paid via credit cards? TD Bank also has options for accepting credit card payments. It has merchant solutions for both in-store and on-the-go needs, with a variety of Clover point-of-sale systems.

Payroll

If figuring out how to do payroll yourself sounds like it would take too long (we get it), you might be interested in TD Bank’s payroll services. TD Bank will assign you a payroll specialist who can take care of all that messy stuff, like calculating taxes.

You can even get HR help through TD Bank’s payroll services—perfect for when you know you need HR but don’t have the budget to add an HR specialist to your payroll.

Prepaid debit cards

Finally, TD Bank has three types of prepaid Visa debit cards. These range from a one-time use card (maybe to give employees a little holiday cash) to a reloadable card designed for payroll. They work pretty much like any debit card would, so you and your employees can use them just about anywhere.

The takeaway

TD Bank isn’t for everyone—such as businesses not on the East Coast or business owners that prefer to do everything online. Even so, many small-business owners will like the wide range of financial products and services that TD Bank has to offer, not to mention the flexibility provided by its extended hours and online banking options.

Keep an eye on your business bank account—whether at TD Bank or somewhere else—by checking out our guide to the best small-business accounting software.

Related reading

TD Bank FAQ

Whether TD Bank is a good bank or bad bank really depends on your business’s specific needs. Overall, we think it’s a good bank for businesses on the East Coast (where TD Bank operates) that want more flexibility when it comes to banking hours.

But if you’re looking for rock-bottom prices or super-high savings interest rates, TD Bank probably isn’t the best bank for you.

We recommend TD Bank over Chase bank, no question.

That’s largely because, as you can read in our Chase review, Chase has a long history of shady activity. And since TD Bank offers cheaper banking options anyway, we don’t see much reason to go with the sketchier bank.

What are the cons of TD Bank?

TD Bank has a few big cons.

First, it doesn’t have any free business checking account. All its accounts come with some monthly fee (though you can waive the fee on many accounts). Second, TD Bank only serves businesses in 15 states along the East Coast. That makes it pretty limited in scope. And third, TD Bank has below-average customer reviews. While none of the reviews are too concerning, it’s definitely not the best-loved bank out there.

Methodology

We looked up banking costs, account options, lending options, customer reviews, and even more details about TD Bank. We compared our findings with findings from dozens of other banks. Our score and review of TD Bank reflect how it stacks up against those other banks.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.