We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Paycheck Protection Program Guide: Coronavirus Relief Loans for Small Businesses

COVID-19 has affected small businesses across the nation―and it’s not over yet. Businesses in many industries and areas are struggling to make ends meet.

The new Paycheck Protection Program (PPP) can help. It offers low-interest business loans to eligible businesses. These loans can be used to keep the lights on and keep workers employed in these difficult times.

In this guide, we’ll explain what the PPP is, how it works, who’s eligible, and how you can get your money. We’ll also point you toward some other programs and resources for businesses affected by coronavirus.

Paycheck Protection Program 101

In late March 2020, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, was signed into law. The CARES Act contains many programs and provisions meant to help the US economy survive the coronavirus crisis―including the Paycheck Protection Program.

The PPP offers special business loans for small businesses affected by COVID-19. These loans can be used for payroll, rent, utilities, and similar expenses. And unlike most business loans, PPP loans have very low interest rates.

PPP loan details

Of course, the real standout feature is loan forgiveness. If you use your loan for approved uses, you may not have to pay the whole thing back.

On a technical note, the Paycheck Protection Program goes through the U.S. Small Business Administration (SBA). As with most types of SBA business loans, that means you apply for your loan through a participating lender. The SBA then guarantees the loan, which basically means it promises that the lender will get paid.

But you probably care more about how you can actually use your PPP loan. So let’s dive a little deeper into the program details.

Paycheck Protection Program loan details

PPP loans have some strict rules and regulations you should understand before you apply.

Loan size, rates, and fees

You can potentially get up to a $10 million loan from the PPP, but your business’s maximum loan size depends on its payroll costs. The PPP caps your loan size at 2.5 times your monthly payroll costs. So if, for example, your monthly payroll expenses average $300,000, you can get a maximum of $750,000. (You’ll calculate these monthly payroll numbers based on 2019 data.)

But what counts as payroll costs for the purposes of the program? Good question.

PPP-eligible payroll costs

Regardless of your loan size, your interest rate will be 1%. If you don’t know much about business loan rates (understandable), then let us assure you that 1% is very, very low. It’s several percentage points lower than a normal “good” interest rate.

Plus, PPP loans don’t come with any of the usual loan fees. Most business loans (including SBA loans) come with extra costs like origination fees or packaging fees. But you won’t pay any of those―or any other fees―on your PPP loan.

Paycheck Protection Program loans have a two-year repayment term. But as we mentioned above, you may not have to pay your loan back.

By signing up I agree to the Terms of Use.

Deferred payments and forgiveness

When you first take out your PPP loan, you’ll automatically get deferred payments for six months. That means you won’t have to pay any payments until those six months are up. Remember, though, that your loan will still accrue interest during this period.

But you can get more than deferred payments. With loan forgiveness, your entire loan balance can be fully forgiven.

You’ll have to meet a few conditions to qualify:

- Use the loan for approved purposes.

- Keep worker headcount the same for eight weeks.

- Maintain salary and wage levels for eight weeks.

We’ll cover the approved uses in detail in just a moment, but right now we want to point out that only 25% of the forgiven amount can have been used on non-payroll costs. So keep that in mind as you use your loan funds.

Note also that you can keep your worker headcount up either by keeping workers on or by rehiring. And salary level maintenance applies only to salaries under $100,000.

If you don’t meet any of these conditions, the forgiven amount will decrease. You might even have to pay the whole thing back.

But assuming you do meet those conditions, you can apply for PPP loan forgiveness with your lender.

Now, we’ll be super honest: Right now, you can’t get much information about how loan forgiveness will actually work. The details we’ve given you are pretty much all that’s out there.

We haven’t been able to find any specific details on when you can get your loan forgiven, for example. We assume you can apply after the eight-week period, but we don’t know for sure. (Many loans that offer forgiveness require you to make a certain number of payments first, even if they’re interest-only payments.)

We expect more concrete information to come out over time (again, this program is brand new, and it’s kind of a busy time for the people in charge). We’ll update this guide if we find anything.

Until then, we encourage you to ask your lender for specific details on how loan forgiveness will work.

Loan uses

You can’t use your PPP loan for just anything. The program was designed specifically to help businesses survive the COVID-19 pandemic. So the use cases are pretty specific:

- Payroll (including salary and paid time off)

- Insurance premiums

- Mortgage interest

- Rent

- Utilities

That’s it. If you want to do something else, you should probably take a look at other business loans. (SBA 7(a) loans have relatively low interest rates and far more approved uses, so they may be a good option.)

And remember, while you can use your loan for all those approved uses, 75% of the forgiven amount must be payroll specifically. So spend carefully. (And keep records of your spending.)

Paycheck Protection Program eligibility

Like the sound of PPP loans? Well, good news―you probably qualify.

In fact, there’s really only one test: you must employ fewer than 500 workers.

Unlike other business loans, your credit score doesn’t matter. Neither does your annual revenue or your time in business (assuming, of course, your business was around before this pandemic hit in February 2020). You also won’t have to offer any collateral or even a personal guarantee.

All sorts of businesses can apply for a PPP loan. That includes these types of organizations:

- Nonprofits

- Self-employed individuals

- Contract workers

- Sole proprietorships

- Veterans organizations

- Tribal organizations

If you’re not sure if you qualify, you can take a look at the SBA’s FAQ about PPP loans. It includes some niche cases about seasonal businesses or businesses with more than 500 employees that may still qualify. (Warning: it’s a little dense.)

How to apply for a Paycheck Protection Program loan

If your business qualifies for the PPP, you can apply through the lender of your choice. All sorts of lenders are participating in this program. You can apply with any SBA 7(a) lender, any federally insured bank, or any federally insured credit union.

We recommend online lenders and lending marketplaces (like Lendio), since they seem to be handling application traffic much better than traditional lenders right now.

No need to wait on your application either. As of April 10, 2020, all types of businesses can apply. (There was a previous waiting period for self-employed and contract workers.)

And remember: there is a funding cap on the Paycheck Protection Program, so you should apply as quickly as you can. Yes, you can apply through June 30, 2020. But for the best chance at getting money, make your application a priority.

Other COVID-19 relief for small businesses

We love the Paycheck Protection Program and believe it will benefit many small businesses. But it’s not the only thing out there to help business owners cope with coronavirus.

We’ve put together a small-business guide to the CARES Act that explains all the ways the coronavirus stimulus package can help small-business owners.

And even before the CARES Act passed, the SBA was offering economic injury disaster loans for small businesses affected by COVID-19.

Paycheck Protection Program vs. disaster loans

We gave you all the details about the PPP above. But you can also get SBA disaster loans, designed to help businesses cope with economic injury as a result of coronavirus.

As you can see, SBA disaster loans come in smaller loan amounts than PPP loans, and they have higher interest rates (though still very low and competitive).

So why would you want a disaster loan?

Well, first of all, when you get an SBA disaster loan, you can qualify for an immediate advance of $10,000―and you don’t have to repay it. In other words, you get a $10,000 grant.

SBA disaster loans also have a few more approved uses than PPP loans (though not many). In addition to the things you can use a PPP loan on (like payroll and utilities), you can use SBA economic injury disaster loans on all sorts of existing debt, accounts payable, and bills. So if you’ve got big bills that aren’t strictly utilities or rent, a disaster loan might be a better fit.

And finally, as we mentioned earlier, there’s a cap on the Paycheck Protection Program. There’s a good chance funds will run out. If that happens, economic injury disaster loans will look a lot more appealing.

(Also, the SBA was extending disaster loans long before the CARES Act passed. It was the only option for a while.)

At any rate, both loan programs are providing valuable funds at low costs to business owners.

The takeaway

We understand how hard COVID-19 has been on you and your business. While we know that a Paycheck Protection Program loan won’t solve all your problems, we hope it can help your business stay on or get back on its feet.

Whether you decide to get a PPP loan or a different loan, make sure you understand how much it will cost you with our business loan calculator.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

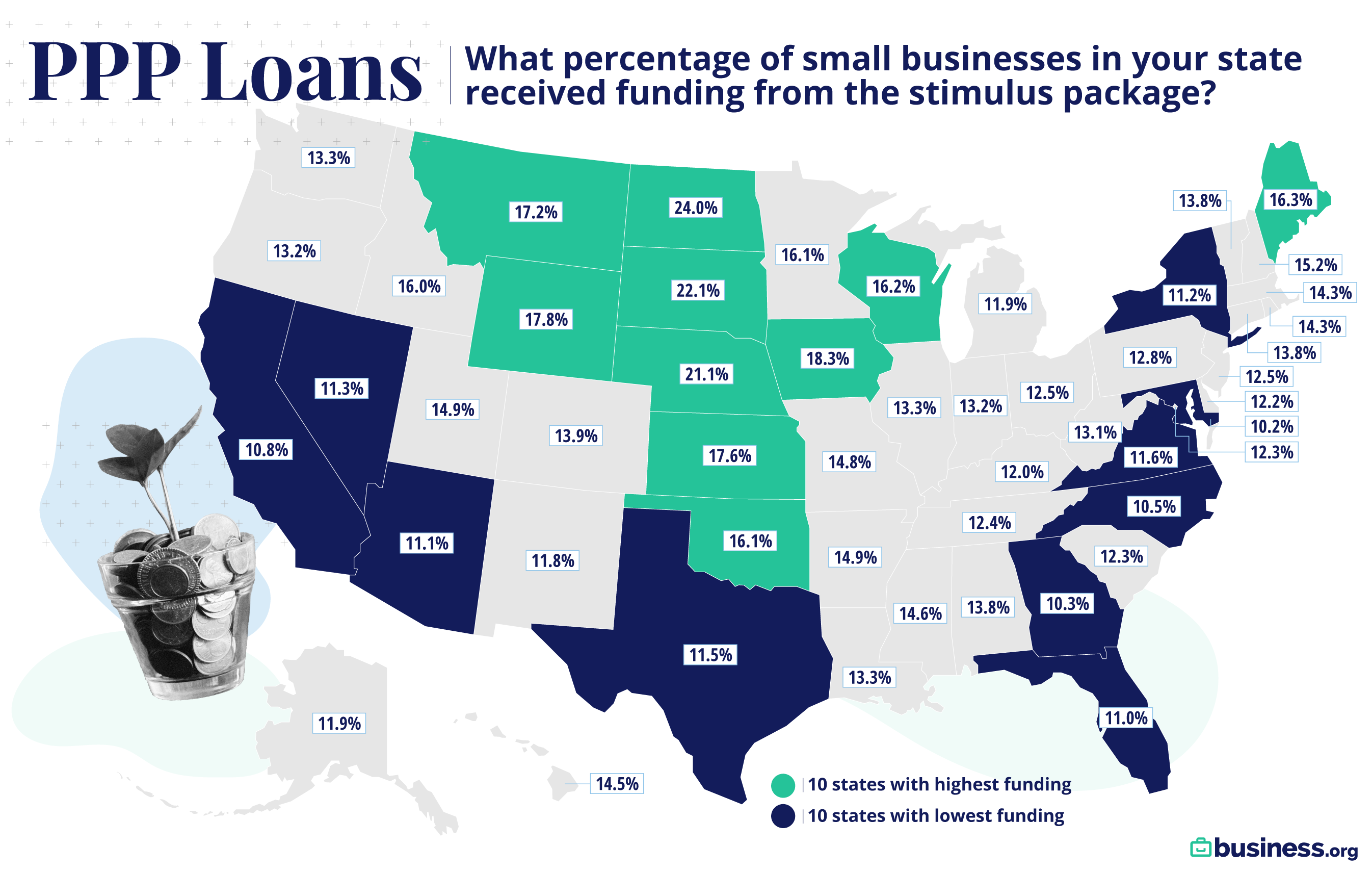

How Many Businesses in Your State Are Actually Getting a PPP Loan?

On May 3, 2020, the SBA announced that it had processed a total of over 3.8 million loans—after the second round of Paycheck Protection Program funding brought the total funding to $659 billion.

According to a statement released by U.S. Treasury Secretary Steven T. Mnuchin and U.S. Small Business Administration Administrator Jovita Carranza, the loans are “saving millions of jobs and helping America’s small businesses make it through this challenging time.”1

We’ve analyzed the data here at Business.org to show you exactly how many businesses are getting Paycheck Protection Program loans in your state.

The best (and worst) states for PPP funding

Low financing percentages show a serious need for more loan capital

The second round of PPP funding is underway, and despite this second infusion of cash into the small-business economy, many states are still stuck with a low percentage of loan approvals.

States with smaller business populations tended to have the highest percentage of loans funded both before and after the second round of funding. The 10 most financed states all have fewer than 500,000 small businesses, while many states in the bottom 10 have millions of small businesses.

One piece of good news from this second round is that per-state funding percentages more than doubled for all states in the current bottom 10. Unfortunately, this doubling is not reflected in the national total.

Only 7.8% of small businesses across the US have been approved for funding, up from 5.7% after the first round. The Paycheck Protection Program will do a lot of good for those 7.8% of businesses who were approved, but what about all the businesses who didn’t get financing? What about the states that still have low funding percentages?

At only 10.8% financing (up from 2.8%), California’s small-business ecosystem is still taking a major hit. Even businesses in the 24% (up from 15%) funded state of North Dakota are still struggling to recover from this economic crisis. There’s simply not enough funding to meet the ever-increasing needs of small businesses fighting to stay afloat right now.

That’s why many small businesses across the nation are calling for a third round of PPP funding.

Was the second round of funding enough?

Despite a number of businesses calling for a third round of PPP loans, these loans aren’t optimal for all kinds of businesses in trouble right now. Remember PPP loans are largely meant to cover payroll, but what about all the businesses with financial needs that outweigh their payroll liabilities? These businesses are just as valid and necessary to our economy.

Additionally, there are a number of businesses who do have severe payroll needs that have yet to receive funding. So in answer to the question of whether this second round was enough, the answer is a resounding no.

Methodology

Using the U.S. Small Business Administration’s data, we’ve taken the total number of small businesses in each state and divided it by the total number of PPP loans funded in each state, giving us the percentage of small businesses that actually received funding in each state.2,3,4

The takeaway

Congressional allocations of additional funds are a must. That’s why Business.org is adding its name to the list of those taking a stand for small businesses. There’s no better way for our federal government to invest tax revenue than by putting dollars into the hands of those small businesses who keep our economy alive and workers employed.

Sources

- U.S. Small Business Administration, “Statement by Secretary Mnuchin and Administrator Carranza on the Paycheck Protection Program and Economic Injury Disaster Loan Program”

- U.S. Small Business Administration, “2019 Small Business Profiles for the States and Territories”

- U.S. Small Business Administration, “Paycheck Protection Program (PPP) Report”

- U.S. Small Business Administration, “Paycheck Protection Program (PPP) Report: Second Round”