We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

21 Tips for Getting Invoices Paid on Time

That’s why we asked business owners to share their secrets to receiving speedy payments—and they delivered! Check out these 21 tips and learn how you can stop chasing payments.

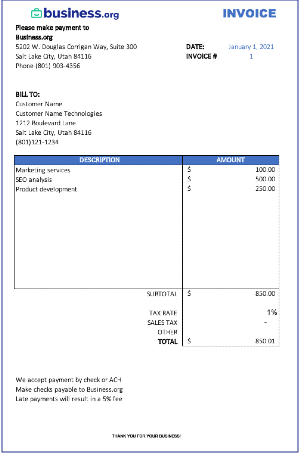

1. Design your invoices with professional flair

It may seem small, but the appearance of your bills is crucial. If your bills don't look professional, it may affect how clients perceive your company. Some customers may believe they can push your payments to the bottom of the queue. The design of your invoice can encourage speedier payment by drawing attention to important information like the amount due and due date, where and how to pay, what the invoice is for, and who to contact with concerns. Keep your bills basic, straightforward, and uncluttered, and use color to draw attention to the most critical details. According to one study, writing Please and Thank You on your invoices can help you get paid faster. Finally, because the invoice represents your brand and company as a whole, include a professional logo and general contact information so your customer doesn't have to look for it.

-Daniel Foley, Founder of Daniel Foley SEO

2. Make invoices as clear as possible

Even the tiniest bit of uncertainty slows things down. Itemise. Costs, fees, upcharges, and overtime rates should all be discussed upfront. Then, on the invoice, itemise these expenses. Customers want to know what they're getting for their money. You'll be paid quicker if they have less queries regarding your invoice.

-Ebony Chappel, Co-founder and CMO FormsPal

3. Set upfront payment terms

For freelancers and consultants struggling to get paid in a timely manner, consider setting upfront payment terms. If a new client is unsure, offer references to previous or current clients. Upfront payment terms will save you time and energy otherwise spent chasing down payments. Just be ready to deliver as promised once payment is received!

-Jamie Hejna, Owner of Ollie Marketing

By signing up I agree to the Terms of Use and Privacy Policy.

5. Send from a separate email account

Although your company may only have a few employees, you can set up an email address such as invoicing@example.com or accounts@example.com to give the idea that you have a separate finance department. This means you may keep your warm and friendly relationship with the client going by using your regular email account. Also, for tight financial diaries, include your invoicing or accounting address.

-Lee Grant, CEO at Wrangu

6. Know the payment processing time

Ask for the payment process window time of the client so you can make adjustments on your invoice preparation next time. If the client says it takes five to seven days before the payment is released then prepare the invoice way ahead of time for faster transactions.

-Tony Grenier, CEO Grenier Media

7. Follow up

It may seem a little simplistic, but I've found that following up immediately after sending an invoice is one of the best ways to get paid on time. As soon as you hit send on an invoice, send a follow-up email from your personal account confirming whether or not the invoice was received. This is a non-intrusive way to receive confirmation from your client, and we've found it typically results in immediate or much quicker payment.

-Justin Kerby, Founder of Something Great Marketing

8. Be flexible with payment methods you accept

While many clients are happy to pay by check or with online payments, the ability to accept a wide range of methods seriously increases the payment speed. Some clients are just set up to pay a certain way, and if you oblige this method, they tend to pay a hell of a lot faster!

-Chris Panteli, Founder of LifeUpswing.com

9. Bill immediately after service or delivery

The best way to get your invoices paid on time is to bill immediately after a service or delivery. Invoice your consumers immediately. Create an invoice as soon as you've delivered products or performed a service. Many businesses only send invoices every couple of weeks or even monthly, prolonging the time it takes to receive payment.

-Benjamin Aronson, Founder at FinancePond

10. Break up invoices into milestones

We rely on invoicing to get paid and although it hasn’t been easy, what has worked for us is we bill our clients often instead of piling up a mountain of debt. Clients will find it easier to pay smaller bills than big ones. So instead of giving them the usual 30, 60, or 90-day payment period, get them to see the benefit of smaller bills paid over a shorter period of time.

-Paul French, Owner of Intrinsic Executive Search

11. Consider overdue fees

You might consider adding late fees to your bills to deter clients from paying you late. This is a permits applications benefit. Calculate the interest that a late-paying customer may owe you with our interest calculator! Additionally to claiming interest, you can charge a company a fixed sum for the cost of collecting late commercial payment.

-Eric Rohrback, CMO of Hill & Ponton

12. Go digital

Stop mailing paper invoices and waiting for checks to arrive. Instead, start sending out invoices and taking payments via email. It's simple to issue online invoices if you use an accounting system like QuickBooks or FreshBooks. Many clients prefer this option since it eliminates the need to write checks and spend money on mailing.

You may also utilize Fundbox Pay to make an online payment request to consumers. Fundbox Pay is a clever method to make sure you're always paid on time while allowing your customers to take advantage of 60-day payment periods. It's a win-win situation: you'll get your money the next business day, but your clients will have to wait longer to pay you.

-Benjamin Stenson, Owner of Norsemen

13. Automate your communication

Send your invoice as early as you can with clear payment instructions—a link to pay right from the email is best. Don't assume your customers will remember to pay it either! They're busy, and the invoice will get buried in their inboxes. Follow up with friendly, automated emails until you get paid. Don't be afraid to add a late fee for repeat offenders or a discount for early payment—just be sure to build that into your price in the first place!

-Jillian Plank, CPA and Founder at Spring Accounting

With plans starting at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business owners alike.

- Track time and expenses

- Create custom invoices

- Accept online payments

14. Go multichannel

They “missed” your email? Check in via phone, Facebook, LinkedIn, IM, company page, wherever you can. Always be polite and don't be too urgent in your actual writing—they know what this is about. You'd be surprised how many times the right DM delivered on the right channel can break through even when countless emails wouldn't.

-Grant Aldrich, Founder and CEO of OnlineDegree.com

15. Keep an eye on your financial flow

When you keep an eye on your financial flow, you'll be notified when funds are running short. You'll be able to tell whether you need to urge customers for payment or look into other financing solutions. If you have a little additional operational cash on hand, you'll be better able to handle any late payments gracefully under pressure.

-Martin Seeley, COO at Leaf Gutter Guards

16. Use incentives

Consider offering your customers discounts for paying their invoices faster. This tactic is particularly relevant for businesses that operate with generous margins. You'll need to determine what the discount is (e.g. 1%), how long is the discount period (e.g. 10 days) and what is the defaultdue date (e. . 30 days).

-Evian Gutman, CEO of Ringcommend

17. Discount one payment for switching to upfront payment

If this month's invoice has been delayed, for example, reach out and say something like, “Hey, would you be interested in paying the next three months up front if I gave you a 20% discount on this month's bill?” That way you'll spur them to pay you what you're owed and get the money for your future work in the same token. It's worth the time you'll save in the future.

-David McHugh, CEO and Founder of My Mixify

18. Maintain great client relationships

This one may sound self-evident, but if you have a good connection with your clients, they won't want to ruin it by paying late. Investing the effort to get to know them and their business can pay off—for example, you might adjust your conditions or modify your invoicing days to coincide with their payment schedule, boosting your chances of receiving fast payment.

-Bram Jansen, Chief Editor of VpnAlert.com

19. Use an accounting software

To avoid late payments, I utilized an accounting software that can manage tasks I often overlook like invoicing. So far, this setup has worked for me for a couple of years now because everything is scheduled and automatic. Adding payment links directly to the invoice is effective.

-James Bullard, Founder of Sound Fro

20. Work with a business lawyer

Lawyers are not just for situations where a customer sues you, they can look over contracts, and make sure that those contracts can be legally enforced. Sometimes showing you have some capability to legally enforce your invoices will deter clients from paying late or even not at all because they do not want to face any prosecution.

-Darren Nix, Founder of Steadily Landlord Insurance

21. Consider cutting ties with repeat offenders

When you run a business you have a job to do and unless you're a big corporation who can pay someone to chase down payments, you can't afford to be distracted and waste significant amounts of time and energy trying to get paid for work you've done. That time and energy could be used to work for paying clients instead. Cutting ties with a client should of course be a last resort, but it should still be an option in your playbook if need be.

-Patrick Connelly, Co-founder of Stellar Villa by Laura

More invoicing tips

Want to learn more about best billing and invoicing practices, check out these resources.